Note that I am not a career researcher in this space. I do not claim to be an expertise in these manners. I hope it sparks discussion around how we can contribute to add more quality information to sensitive issues.

What happens with actuaries when the lights go out? Between the Spreadsheets exposes the hidden secrets of the actuarial profession through satirical articles and thought provoking pieces. Ideas expressed in this blog are my own. They do not represent any company or organization.

Sunday, June 14, 2020

Do You Know More About Your Uber Driver Than Your Local Police Officer?

Friday, June 12, 2020

Manager Thought Actuary was Protesting for a Decade

The manager was stunned.

For the past ten years the actuary had been virtually silent at work and avoided most team building exercises.

The manager admitted she completely misread the lack of eye contact as an intentional act designed to bring awareness to some cause.

“I thought he was making a statement about the corporate world not seeing people as people or something. I thought it was strange to protest in the middle of a protest.”

The confusion went both ways. The actuary explained (through email) that the manager was just really a supportive person. She’d often say “I’m with you.”

When asked why she never inquired about what issue the imagined protest was concerning, her explanation was simple “I didn’t want to look like a fool.”

After a follow up meeting, both sides agreed to make changes. The manager is making less assumptions and learning a lot more about her staff. The actuary committed to go to more happy hours. As a result the work environment is stronger than ever and morale is super high.

They are hoping to share these tactics with other groups. They have cautious optimism that they might find out what the people in Corporate Business Strategy actually do.

Monday, April 6, 2020

Book Review: Being Wrong - Adventures in the Margin of Error by Kathryn Shulz

Wrongness is a small obsession of mine.

A while back I put out a piece on the blog that looked at occupations where being wrong is part of the job description.

And more recently I won an essay contest by explaining that I am an Idiot.

I love stories of the hapless fool - the Don Quixote's and Confederacy of Dunces of the world.

I picked up this book from a really good article series "Studying Studies" by a smart dude named Peter Attia. I may keep working through his reading list.

If you're the kind of person who loves droning about the nature of the universe at your favorite craft brewery, I know I am, this book is for you.

A while back I put out a piece on the blog that looked at occupations where being wrong is part of the job description.

And more recently I won an essay contest by explaining that I am an Idiot.

I love stories of the hapless fool - the Don Quixote's and Confederacy of Dunces of the world.

I picked up this book from a really good article series "Studying Studies" by a smart dude named Peter Attia. I may keep working through his reading list.

If you're the kind of person who loves droning about the nature of the universe at your favorite craft brewery, I know I am, this book is for you.

Thursday, March 19, 2020

When a Virus Goes Viral

In the words of Twenty One Pilots, “I’ve been thinking too much...” please indulge me in some musings on our current state of affairs and some of the implications.

Thursday, August 8, 2019

Advice from a Pro! 37 Life Lessons.

Between the Spreadsheets is happy to add Mark Farrell's blog to our links.

Here are his "37 Lessons Actuarial Science Has Taught Me About Life"

Here are his "37 Lessons Actuarial Science Has Taught Me About Life"

Tuesday, August 6, 2019

Eat Your Numbers

In case you missed it, I wrote a Cover Feature for Contingencies Magazine. You may start to see more posts related to this theme in the near future. Enjoy!

Saturday, July 13, 2019

Book Review: Scythe Series by Neal Shusterman

We’ve conquered death! Awesome! Well more accurately , we developed nearly omniscient Artificial Intelligence (the Thunderhead) that solved all our problems. The answer wasn’t 42 after all.

However, a world with no death faces two challenges.

1. Death (and avoiding it) is a motivating factor to live well.

2. The planet can only handle so many people.

To counter these issues, the creators of the Thunderhead established a league of special individuals that are exempt from monitoring by the Thunderhead. Known as the Scythdom, these people have a singular mandate - the administration of mortality.

Tuesday, January 8, 2019

2018 Actuarial Awards

Roll out the red carpet! Awards are everywhere....Emmys, Grammys, ESPYs, oh my!

While not given the exact same spotlight, or fancy evening wear, actuaries give out their own sets of Awards. The 2018 summary is below.

Friday, August 10, 2018

Are Actuaries Born or is it a Choice?

When Rita was 3 years old she had a tendency to stack blocks in probability distribution shapes. At first her mother thought the patterns were just imaginative. But then when Rita started making histograms with candy pieces and named her pet hamster 'chi-squared', she understood there was something else at play. Rita is now a junior in college and is bristling with excitement at starting her first internship at an insurance company in the actuarial department.

When Rita was 3 years old she had a tendency to stack blocks in probability distribution shapes. At first her mother thought the patterns were just imaginative. But then when Rita started making histograms with candy pieces and named her pet hamster 'chi-squared', she understood there was something else at play. Rita is now a junior in college and is bristling with excitement at starting her first internship at an insurance company in the actuarial department.Angela is also starting her first internship in the same area. She still isn't sure if the actuarial science will live up to its hype. She's also thinking about the possibility of being a math teacher or trying to make it as a drummer in a female punk rock band.

Both women represent two ends of the hotly debated topic - are actuaries born or is it a choice?

Saturday, July 21, 2018

Between the Spreadsheets and In the Closet

Calling your attention to a new page on Between the Spreadsheets.

This is a resource page where I will share an post items that I find to be useful as a nerd, an actuary, and as a basic human on the planet.

Take a look for yourself and let me know what you think.

Some products are affiliate links.

NERD CLOSET

This is a resource page where I will share an post items that I find to be useful as a nerd, an actuary, and as a basic human on the planet.

Take a look for yourself and let me know what you think.

Some products are affiliate links.

Thursday, June 7, 2018

Big Data needs Big Actuaries

The American Academy of Actuaries recently published a monograph Big Data and the Role of the Actuary.

Some speculate that the Academy may also produce a monolith dedicated to Big Data as well.

Or maybe a monogram.

Either way, what is certain is that Big Data and the applicable statistical methods that come along with it are going to play a significant role in the actuarial profession.

And in order to handle Big Data, you need a Big Actuary.

Some speculate that the Academy may also produce a monolith dedicated to Big Data as well.

Or maybe a monogram.

Either way, what is certain is that Big Data and the applicable statistical methods that come along with it are going to play a significant role in the actuarial profession.

And in order to handle Big Data, you need a Big Actuary.

Thursday, May 17, 2018

Review of the Human Longevity Project Series

Over the past 9 days, a series of videos compiled by The Human Longevity Project, explored various topics related to human longevity. This is not a typical Netflix binge watch, although the old folks they interviewed were quite adorable. The series delivered huge dosages of scientific content from a vast panel of experts.

Monday, March 12, 2018

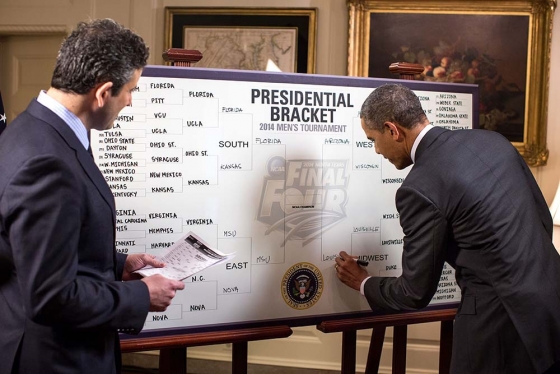

March Madness 2018 - Actuarial School Bracket

Most likely, having an actuarial program has next to zero correlation with NCAA tournament success. I haven't done the full blown anlaysis, I might one day. That said, the tournament does have a degree of randomness, and using actuarial strength as a game predictor is just as good as throwing darts. Possibly better.

The full bracket is available here (may require CBS login):

http://freebracketchallenge.1.mayhem.cbssports.com/brackets/1/njworrell

The full bracket is available here (may require CBS login):

http://freebracketchallenge.1.mayhem.cbssports.com/brackets/1/njworrell

Thursday, March 8, 2018

I'd Like to Thank The Academy....2017 Actuarial Awards Summary

| |

The Oscars completes the awards season. Awards are everywhere....Emmys, Grammys, ESPYs, oh my! Even the POTUS submitted his own version of awards.

While not given the exact same spotlight, or fancy evening wear, actuaries give out their own sets of Awards. The 2017 summary is below.

Friday, November 10, 2017

New Actuarial Standard on How To Put on Pants

Recent ASB proposals for modeling, pricing, and assumption setting standards of practice seem to be starting a trend of codifying every single action an actuary takes. The latest release seems to confirm this theory.

An exposure draft, titled "Lower Body Coverings" is currently in progress.

Apparently there is much concern in the actuarial community about the quality of work can vary based on how one applies lower limb coverings. An improper procedure may result in further deterioration of judgment, confidence, and overall work product. To put it one way, the exposure draft deals with the risks of feeling drafts while exposed.

Saturday, October 7, 2017

New Insurance Products Announced for Undead

In an effort to find new business, insurers are dabbling into new, untapped markets.

Traditionally the insurance industry protected against two risks - dying to soon via Life Insurance or outliving your assets (longevity) via Annuities.

The limiting factor to each of these is that you either had to be alive or die to collect a claim. This was an issue if you were already dead, sort of dead, or came back to life after death. Now, a new set of products is coming on to the market to meet those needs.

Friday, September 1, 2017

Bayesian Rhapsody

The whole thing with Bayes is about updating likelihoods given more information. Let's see how Queen takes us on a Bayesian journey.

Update: The Bohemian Rhapsody movie did not take any of this information into account.

Update: The Bohemian Rhapsody movie did not take any of this information into account.

We start with a fundamental question about the nature of reality, and fact about landslides.

Is this the real life? Pr(Real Life) = ?

Is this just fantasy? Pr(Fantasy) = 1 - Pr(Real Life)

Caught in a landslide,

No escape from reality Pr(Real Life | Caught in a landslide ) = 1

Is this just fantasy? Pr(Fantasy) = 1 - Pr(Real Life)

Caught in a landslide,

No escape from reality Pr(Real Life | Caught in a landslide ) = 1

Friday, March 3, 2017

The 12th Actuarial Speculative Fiction Contest

Below are stories from the 12th Actuarial Fiction Contest, with my own quick synopsis of the story and images from around the web that might work as a cover. Summaries and cover art are my own interpretations. Please vote on your favorites.

Thursday, January 5, 2017

You Wouldn't Believe What Jacob Bernoulli Looks Like Now

What would it be like if historic mathematicians lived today and were as popular as some of the most notorious celebs? In this series of posts (#mathgonewild) Between the Spreadsheets makes parallels between founders of major mathematical thought and current celebs, and we create some tabloid headings. Feel free to comment, argue, or add to the list.

The Bernoulli's

Ever heard the song "John -Jacob-Jinglehiemer Schmidt?" Probably came from these guys, where most dudes in the family are names Johan or Jacob or Nick. The family has an impressive resume, but the tabloids are pretty good too.

Wednesday, October 19, 2016

Models and Drunks

First, models. I have long been a fan of the phrase that "all models are wrong, but some are useful." However, much to my shame, I know not where it came from. Now I do. Thank you Twitter for enlightening me about George Box and his paper. Not only am I know aware, but I have been shaken to my core. More on that later.

Second, drunks - and specifically how they walk. The Drunkard's Walk: How Randomness Rules Our Lives by Leonard Mlodinow (http://leonardmlodinow.com/) is what I call a mathematician's apologetic - an attempt to make math accessible to the masses. His book is part of my attempt to work through a reading list (again - thanks Twitter!) of math texts. I give the guy a couple of stars for effort on the mathematical narration, but the real gold is in the cast of characters. They will be featured in a future post. In this post, I will leave you with flip flops.

Sunday, September 4, 2016

Vitality Compass vs. Longevity Illustrator

If you want to know how long you are going to live, you could consult a palm reader or some other mystic. Alternatively you could look to science, math and academia. But who wins between academics and actuaries?

Wednesday, August 17, 2016

Engage or Disengage?

Recently, the Society of Actuaries deployed their latest community site, SOA Engage.

https://engage.soa.org/home

While unlikely to get the traction of the Actuarial Outpost or a Reinsurance sponsored Happy Hour at a symposium, the threshold is pretty low. A few actuaries showing up will likely be considered a win.

This initiative brings to mind a past article by BTS, about actuaries engineering anti-social Media.

http://betweenthespreadsheets.blogspot.ca/2013/04/actuaries-engineer-anti-social-media.html

https://engage.soa.org/home

While unlikely to get the traction of the Actuarial Outpost or a Reinsurance sponsored Happy Hour at a symposium, the threshold is pretty low. A few actuaries showing up will likely be considered a win.

This initiative brings to mind a past article by BTS, about actuaries engineering anti-social Media.

http://betweenthespreadsheets.blogspot.ca/2013/04/actuaries-engineer-anti-social-media.html

Saturday, July 9, 2016

If Donald Trump Ran for SOA President

The current political pageantry and it's primary peacock, one Donald J Trump, has inspired Between the Spreadsheets to ponder, if we could find it palatable, a parallel universe in which this prima dona found himself placed on the ballot for SOA President.

We pulled the questionnaire from the society's website and did our best to imagine how the Donald may have answered, pulling direct quotes where possible, indicated by " ", everything else is fiction.

Readers are welcome to add Trumpisms that may apply.

We pulled the questionnaire from the society's website and did our best to imagine how the Donald may have answered, pulling direct quotes where possible, indicated by " ", everything else is fiction.

Readers are welcome to add Trumpisms that may apply.

Wednesday, June 22, 2016

Actuarial @ASAPscience

We call ourselves actuaries, but how many of us could call ourselves scientists as well? After all, the field we practice is Actuarial Science.

And yes, bulk of our discipline is math and probability based, but let us not kid ourselves that we are unique in our application of these subjects.

And yes, bulk of our discipline is math and probability based, but let us not kid ourselves that we are unique in our application of these subjects.

- The Random Walk a.k.a Brownian Motion - comes from physics

- Regressive models are scattered across scientific fields from sociology to biology

- Sampling Techniques, a.k.a Experience Studies, are present in marketing and politics

- Game Theory comes from...A Beautiful Mind. Kidding. Economics and psychology

I've always love exploring the science behind the events that we create insurance products for. Recently, I came across the guys at ASAPscience, and their fun YouTube videos. Below are a few that pertain to actuarial concepts.

Monday, June 6, 2016

I Get Knocked Down, But I Get up Again

As an actuary, my life revolves around studying the risks of shitty things happening. I know that the whims of the universe may smite me with some nasty disease or some sleepy bus driver could turn me into a pavement pizza. As such, I have protected myself and my family from the financial strain of such calamities through the purchase of the various insurance products I've grown to love. They're like a family that protects my family...

Then came the day that I never saw coming.

Then came the day that I never saw coming.

Wednesday, March 9, 2016

Paid To Be Wrong vs. Paid to be Right

For today's Nate Note, I'm considering various occupations and various tolerances for "rightness" and "wrongness". My primary question is, in what professions can you be wrong and still keep your job?

Friday, March 4, 2016

Comedian Louis CK Goes Full Actuary

So I'm watching Netflix and enjoying a little comedy when I hear Louis CK make some actuarial statements. In this video clip, you can hear his remarks - note that this YouTube link is not authorized by Louis CK to my knowledge and it is his full special. There is strong language in it. You can find the full version on Netflix or purchase it from Louis CK's website. After watching for a minute or so, let's unpack the statements. I'll try to do it in such a way that even non-actuary's can follow. Other actuaries reading this - my methods are crude, feel free to make it more exact if you desire.

Friday, December 18, 2015

The Fed Awakens - Actuarial Reactions Vary

|

| Image from Jeff Burney at http://www.cartoonmovement.com/cartoon/26133 |

The recent Fed announcement that marked the end of easy money also sparked interesting reactions from the actuarial community.

Friday, September 25, 2015

New Clipped Art - Actuarial Tombstone

I always assumed that I would donate my body to science or get cremated, and not need a tombstone. After this idea popped in my head, I may just get one regardless.

Only actuaries will understand this...

Translations...

Monday, August 17, 2015

If There was a Fantasy League for Actuaries....

Drafts occur at the SOA annual meeting.

Rosters need to include:

3 Pre-ASA Students

2 Post-ASA Students

3 Fully Credentialed Actuaries, one of which must be a consultant

1 Appointed Actuary

1 Chief Actuary

1 Insurance/Financial/Software/Risk Management Company that employs at least 50 actuaries

Scoring:

10 points per preliminary exam passed

5 points first time pass bonus

2 points per FAP module completed

3 points per passed Assessment

20 points per FSA/FCAS exam passed

4 points per FSA module completed

5 points for acheiving any credential (FSA, FCAS, CERA, ASA, etc.)

1 point per hour of CPD

Rosters need to include:

3 Pre-ASA Students

2 Post-ASA Students

3 Fully Credentialed Actuaries, one of which must be a consultant

1 Appointed Actuary

1 Chief Actuary

1 Insurance/Financial/Software/Risk Management Company that employs at least 50 actuaries

Scoring:

10 points per preliminary exam passed

5 points first time pass bonus

2 points per FAP module completed

3 points per passed Assessment

20 points per FSA/FCAS exam passed

4 points per FSA module completed

5 points for acheiving any credential (FSA, FCAS, CERA, ASA, etc.)

1 point per hour of CPD

4 points per speech/presentation at a symposium

7 points for any signed statement of actuarial opinion or rate filing

3 points per hired actuary

-3 points per lost actuary

-5 points for any ABCD greivance filed against anyone on the roster

7 points for any signed statement of actuarial opinion or rate filing

3 points per hired actuary

-3 points per lost actuary

-5 points for any ABCD greivance filed against anyone on the roster

Sunday, August 16, 2015

Society of Actuaries Logos That Didn't Make the Cut

In the latest attempt to rouge the lips of the swine that is the Society of Actuaries brand, (see the Image of the Actuary as the previous campaign), a new logo emerged as the graphical representation of the organization.

The "infinity shield", according the brand website "symbolizes that the SOA is continually evolving to produce forward-thinking education and professional development opportunities. The shield represents a strong, fortified foundation, bound by standards and principles that advance your interests."

Wikipedia calls it an "impossible object".

So, quite simply, the essence of an actuary is represented by an infinite impossibility. Fitting, as much of the public still has no idea what actuaries do and some still doubt that actuaries actually exist. Why not be represented by a geometric symbol from the realm of mythology and legend?

Sources leaked some alternative designs that almost made the cut:

The "infinity shield", according the brand website "symbolizes that the SOA is continually evolving to produce forward-thinking education and professional development opportunities. The shield represents a strong, fortified foundation, bound by standards and principles that advance your interests."

Wikipedia calls it an "impossible object".

So, quite simply, the essence of an actuary is represented by an infinite impossibility. Fitting, as much of the public still has no idea what actuaries do and some still doubt that actuaries actually exist. Why not be represented by a geometric symbol from the realm of mythology and legend?

Sources leaked some alternative designs that almost made the cut:

Monday, July 27, 2015

Hug An Actuary!

When it comes to Actuarial swag, there's not a whole lot out there. However, recently at a conference, a "Hug An Actuary" hat made a noticeable appearance among the humdrum of business casual. This inspired the following list of reasons (if you needed any) to Hug an Actuary!

- Actuaries won't bite. They are gentle creatures, although solitary at times (like cats in a way) - which leads to...

- It will force an actuary to interact with another human being

- They may have just learned if they passed or failed the exam they were studying for and need to celebrate or be comforted.

- They may be studying for an exam, in which case they could use some reassurance and a little confidence boost.

- Some analytical skills might rub off. At the very least you might find yourself a little more proficient in Excel.

- It's a good way to confirm the actuary is not a robot.

- It's a good way to confirm that actuaries actually exist.

- If lots of actuaries get hugs, then the prices of insurance in the market might drop, starting an economic boost.

- It might lead to steamier forms of physical contact (this may be a drawback)

- HUGS ARE AWESOME!

Monday, July 6, 2015

The Joke's on us

Caught a link to a set of insurance jokes and some feature actuaries.

One is a "twist" on how many actuaries it takes to change a lightbulb.

I have my answer

Sunday, May 24, 2015

Why do churches buy insurance?

After all, don't most sacred texts encourage a sort of dependency on the higher powers? Does the act of purchasing protection from "acts of God" seem to imply a lack of faith? Or is it simply just a good idea and a prudent way to manage these houses of worship?

Saturday, May 9, 2015

Nate-rodamous

For much of my actuarial career, I have used computer programs to collide one set of numbers (representing you and me and other insured folks) with another set of numbers (representing fate and chance) to produce a third set of numbers which I use to figure how much to charge for a promise, or to make sure that the insurance company can keep its promise.

Some insurance is short term in nature, but things like Annuities, Long Term Care and Life Insurance require forecasts far into the future, often 30 to even 50 years! 30 years ago there were no smart phones, no YouTube videos of cats, and "Googol" meant a really large number. (10 with 100 zeroes after it).

The forecasting models we use are not as advanced as Doc's DeLorean.

To be honest, Actuaries don't know what exactly will happen in the future. Although I played with this idea in my more humorous posts (Scenario 241 Sucks and Actuary Accidentally Invents Time Travel). The models are basically advanced tools to see how many times you'll get snake-eyes on the craps table if you played once a month for the next three decades. Thankfully, most insurance risks are predictable in the long run.

But, financial mathematicians have also had to eat some crow when the unpredictable happens and models fail.

For me, I think that running a predictive model without considering what the future might look like is like a meteorologist predicting the weather using a computer and never looking out the window. For instance, I think the recent study from the Global Challenges Foundation on 12 Risks With Infinite Impact should be mandatory reading. Full report here, summary here.

For me, I think that running a predictive model without considering what the future might look like is like a meteorologist predicting the weather using a computer and never looking out the window. For instance, I think the recent study from the Global Challenges Foundation on 12 Risks With Infinite Impact should be mandatory reading. Full report here, summary here.

I therefore submit for your consideration some predictions of events (good and bad) that will occur over the next 30 years (or sooner!):

Some insurance is short term in nature, but things like Annuities, Long Term Care and Life Insurance require forecasts far into the future, often 30 to even 50 years! 30 years ago there were no smart phones, no YouTube videos of cats, and "Googol" meant a really large number. (10 with 100 zeroes after it).

The forecasting models we use are not as advanced as Doc's DeLorean.

To be honest, Actuaries don't know what exactly will happen in the future. Although I played with this idea in my more humorous posts (Scenario 241 Sucks and Actuary Accidentally Invents Time Travel). The models are basically advanced tools to see how many times you'll get snake-eyes on the craps table if you played once a month for the next three decades. Thankfully, most insurance risks are predictable in the long run.

But, financial mathematicians have also had to eat some crow when the unpredictable happens and models fail.

For me, I think that running a predictive model without considering what the future might look like is like a meteorologist predicting the weather using a computer and never looking out the window. For instance, I think the recent study from the Global Challenges Foundation on 12 Risks With Infinite Impact should be mandatory reading. Full report here, summary here.

For me, I think that running a predictive model without considering what the future might look like is like a meteorologist predicting the weather using a computer and never looking out the window. For instance, I think the recent study from the Global Challenges Foundation on 12 Risks With Infinite Impact should be mandatory reading. Full report here, summary here.I therefore submit for your consideration some predictions of events (good and bad) that will occur over the next 30 years (or sooner!):

Sunday, April 26, 2015

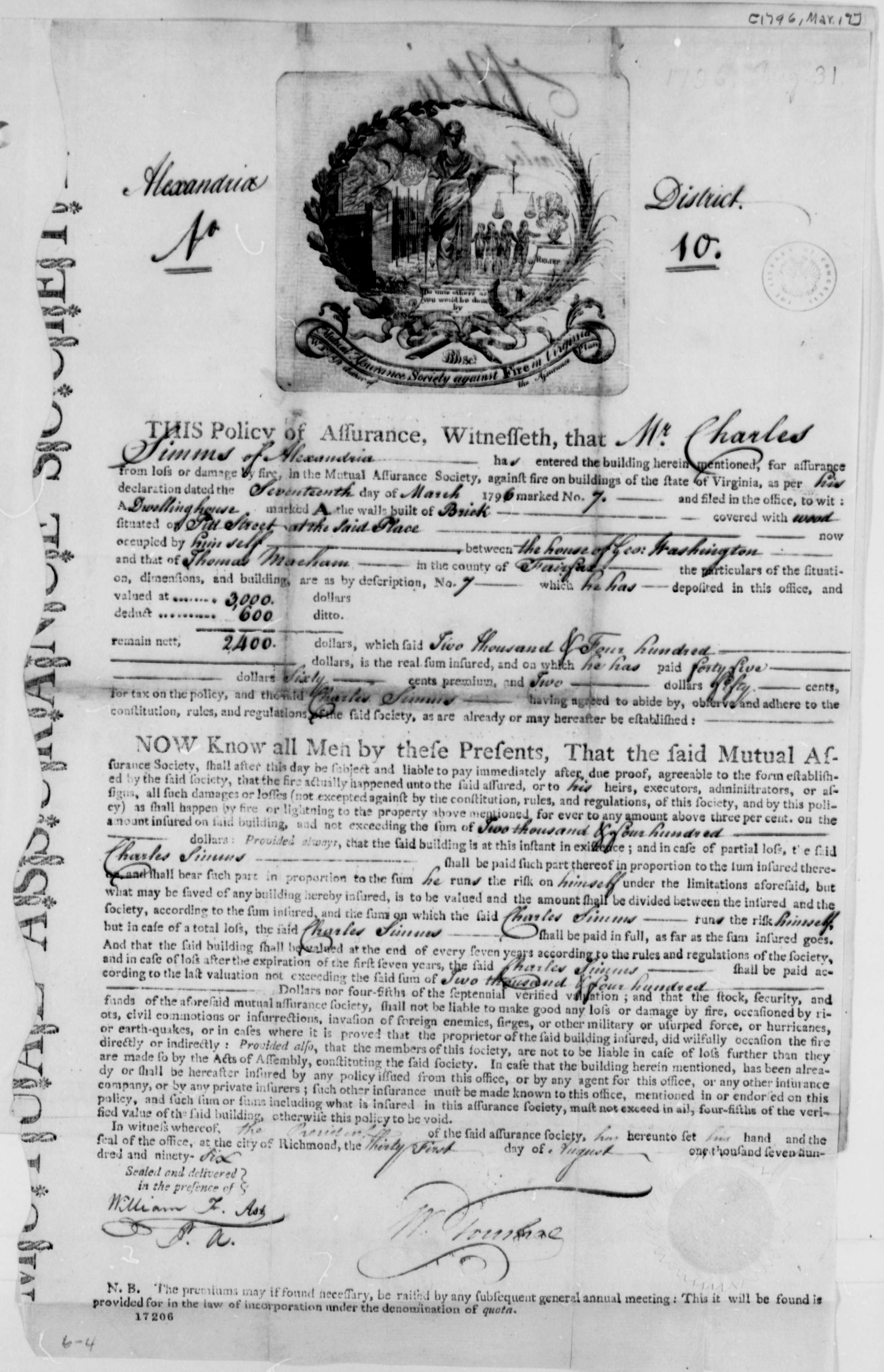

Insurance Commissioner Rejects Filing for Being Completly Understandable

When the filing came across the examiner's desk, she thought it was a joke.

The usual course for insurance contract filings often involves a series of interchanges between the insurance company and the regulatory authority before a product can be sold to the public. Insurers often wonder if the commissioners actually read what they wrote. Commissioners often wonder if the filing was written in English.

The usual course for insurance contract filings often involves a series of interchanges between the insurance company and the regulatory authority before a product can be sold to the public. Insurers often wonder if the commissioners actually read what they wrote. Commissioners often wonder if the filing was written in English.

"The writing was so crisp - simple words, short sentences, you know that sort of thing. I understood it after the first reading. And that's what I found so alarming." Explained the examiner.

The usual course for insurance contract filings often involves a series of interchanges between the insurance company and the regulatory authority before a product can be sold to the public. Insurers often wonder if the commissioners actually read what they wrote. Commissioners often wonder if the filing was written in English.

The usual course for insurance contract filings often involves a series of interchanges between the insurance company and the regulatory authority before a product can be sold to the public. Insurers often wonder if the commissioners actually read what they wrote. Commissioners often wonder if the filing was written in English.

When the document in question reached the desk of this particular Commissioner, he knew that something must be done.

Saturday, April 11, 2015

New Feature - Nate Notes

So, I'm going to start dumping them here and tagging them #natenotes. They should have some shred of actuarial connection. I'd usually dump this stuff on to the Actuarial Outpost, but I want this blog to serve as a bridge between actuaries and the public.

Over the next few months, I'll be exploring topics like:

- The Impending Robot Revolution

- Nate-rodamous - My Predictions of the Future

- Taking Chances and Making Bets

- The Next Phase of Human Evolution

- Why Do Churches Buy Insurance?

- Are Actuaries Overpaid?

...and more. So stay tuned!

Sunday, March 22, 2015

A New Way To Fill Out March Madness Brackets

Why not choose actuarial schools? For my latest distraction, I am chronicling the basketball tournament results for schools with actuarial programs.

Should help in your office pools, or any talented hoopster with math skills trying to decide on which school to go to.

Would love to get help from anyone who's interested.

http://goo.gl/sfIVZ2

Thursday, February 26, 2015

Actuarial Dis-Organizations

What started as a "yo-momma" joke has escalated into a full out battle for middle earth. At least, that is how it seems as some major actuarial organizations engage in a turf war.

To recap for the general public:

- Actuaries are not mythical creatures. They exist and provide a service to the public through pricing and mitigating financial risks.

- Several actuarial organizations help actuaries accomplish that goal.

- Some are country specific.

- Others are international.

- Others are practice oriented.

- Individual actuaries can be, and often are, members of multiple organizations.

- Each group has its own concerns, but until recently, they have been more collaborative than combative.

Thursday, November 20, 2014

Awkward Moments Saturate Actuarial Conference

The sun rises. Hundreds of actuaries congregate outside the conference rooms at the resort-hotel, rummaging through stale pastries, fruit that hadn't fully ripened, and fresh brewed coffee.

They try networking. Their efforts are motivated more by obligation, proximity to other actuaries and social norms than strong desires to interact with other human beings.

Sunday, September 21, 2014

Not Actually an Actuary Designation Debated

The Institute and Faculty of Actuaries recently launched a new designation, the Certified Actuarial Analyst (CAA). So it is only logical that the other actuarial bodies keeps pace, which led to the joint effort of the Society of Actuaries and Casualty Actuarial Society. They are considering of their own new qualification for people that are Not Actually Actuaries, or NAA.

The Institute and Faculty of Actuaries recently launched a new designation, the Certified Actuarial Analyst (CAA). So it is only logical that the other actuarial bodies keeps pace, which led to the joint effort of the Society of Actuaries and Casualty Actuarial Society. They are considering of their own new qualification for people that are Not Actually Actuaries, or NAA.Wednesday, August 6, 2014

Gorgeous but Confused Actuaries Join Modeling Section

The Society of Actuaries has unveiled their 20th special interest section. Modeling joins the ranks of Futurism, Long Term Care, and Small Companies.

However, initial participation isn't quite what the founders expected. The target members are the software wizards that get tingly when they hear phrases like "run time" and "parallel processing." They are the type of people who have had their heads in clouds for a while and brag about the size of their data. But this isn't who has joined so far.

Sunday, June 22, 2014

New Clipped Art - Actuarial Fortune Cookies

First there were actuarial horoscopes.

Now there are actuarial fortune cookies. Grab your leftover takeout and crack one of these bad boys open.

Wednesday, May 21, 2014

Actuarial Recruiter Convinces Actuary He's a Perfect Match for MidAtlantic Client Seeking FSA

"She told me I was special," explains a recently relocated actuary. He's talking about a recruiter, someone he's never met. But, "she had a sweet voice and giggled a lot."

Tuesday, April 1, 2014

Monty Python and the Holy Grail - Insurance Propaganda?

Fans of the movie Monty Python and the Holy Grail may celebrate its macabre humor and quixotic antics, but an exclusive Between The Spreadsheets investigation indicates that behind the comedic blundering lurks a campaign for several lines of insurance.

Sunday, November 24, 2013

VP Thinks Actuary’s Input in Meeting is Adorable

In a surprising move during last month’s planning meeting,

an actuary made a comment about the business plan. The comment had nothing to

do with mortality tables, discount rates, or amortization.

In a surprising move during last month’s planning meeting,

an actuary made a comment about the business plan. The comment had nothing to

do with mortality tables, discount rates, or amortization.

Most meeting participants ignored the comment, thinking that

their minds had tricked them. Then the actuary repeated himself.

Sunday, November 17, 2013

Actuary Accidentally Understands NAAJ Article

It happened on an October Saturday morning. An actuarial student was clicking through

links on the SOA website, looking to get to her study material. A couple mis-clicks brought her to The

North American Actuarial Journal (NAAJ).

It happened on an October Saturday morning. An actuarial student was clicking through

links on the SOA website, looking to get to her study material. A couple mis-clicks brought her to The

North American Actuarial Journal (NAAJ). Wednesday, October 9, 2013

New Feature!

I added a link to some actuarial cartoons I created using Office's collection of Clip Art. The collection is appropriately called "Clipped Art". Below is a sample. Enjoy.

Wednesday, September 18, 2013

Grim Reaper Slated for Stand-up Comedy during Life Insurance Awareness Month

September is Life Insurance Awareness month. Across the nation, insurance agents and financial advisors are seizing the opportunity to initiate conversations with their clients about protecting their families. The 2013 Spokesperson for LIAM is former NFL quarterback Boomer Esiason and while his celebrity status might intrigue some, a less publicized event might be the real gem of this year’s campaign.

Thursday, July 18, 2013

Casualty Insurers Revisit Models After Watching Sharknado

Yes, there is an actual

movie called Sharknado. It stars a talented cast led by Tara Reid. It’s getting a bunch of attention lately.

Some of that attention

has reached P&C actuaries.

Wednesday, July 17, 2013

Introduction to ASOPs Says Promotion is Past Due

Recently the AAA held a

webcast to discuss the recent revision to Actuarial Standards of Practice

(ASOPs) where they announced that introduction to the ASOPs would henceforth be

an official numbered standard.

Now, officially ASOP 1,

the former introduction, while proud of the accolade, feels like it has been a

long time coming.

“I mean, really, you

couldn’t have the remaining ASOPs without me.

People think defining terms is inconsequential, but just ask any lawyer

how important definitions are.”

The introduction began

its career in 1989 as a preface. Its new rank bumped ASOP 1 to ASOP 2. The former ASOP 1 declined to comment.

Friday, May 17, 2013

Actuary Accidentally Invents Time Travel

“In trying to change code to add efficiency to a stochastic on stochastic model process, a local actuary stumbled across a way to bend the space time continuum.

Unfortunately, this new feature isn’t very helpful in running models. Even though the actuary knows exactly what will happen in the future, she cannot change past decisions without creating new parallel universes. ( If that is a little tough to follow, watch Back to The Future, it explains everything.)

Thursday, March 28, 2013

Freezing Temperatures Drive Actuaries to Deeper Isolation

When it is this cold, this late in the year, people get grumpier. They spend more time inside, which means they end up watching subpar TV programming. They don’t get much fresh air, and studies show that large quantities of recycled air lead to increased crabbiness. They are forced to spend time with their families, which can make anyone crazy. At least, that’s how the average person responds.

For actuaries, the effect is quite different. They only interact with others because they feel compelled that they have to. The cold weather gives them a convenient excuse to become hermits. Actuaries, if you can ever interact with one, in contrast to the average person, are happier the longer it stays cold. They can spend more time doing actuarial work, reading science fiction and solving Sudoku. If an actuary complains about the cold, it’s only because it’s not cold enough

Wednesday, March 27, 2013

Actuary Complains About Being Overpaid

“If I only made $100K” lamented an actuary recently. Apparently, the idea of paying taxes, being able to afford going out to dinner, having a reliable vehicle, and living in a condo downtown is just too much of a burden.

“If I only made $100K” lamented an actuary recently. Apparently, the idea of paying taxes, being able to afford going out to dinner, having a reliable vehicle, and living in a condo downtown is just too much of a burden.

“I miss those days as student, when my paycheck went to paying student loans and renting out that basement in uptown. I actually had to think about budgeting then.”

To make matters worse, he was recently promoted and got a great PMP rating.

“It was a total nightmare.” He recalls. “I hate bonuses.”

He is trying to figure out what to do with so much cash. He’s tried buying a cabin up north, taking expensive vacations, and purchasing every gadget featured in the latest electronics store magazine. While his summer recreation is thoroughly pleasant, and he has acquired some sweet gear, something is just missing. Until he figures out what that is, he’s going to keep dealing with his unpleasant reality.

“Sometimes, you have to deal with what life hands you, whether you deserve it or not.”

Tuesday, November 27, 2012

Actuary Fined For Excessive Email Signature

He had listed the following designations after his name: FSA, MAAA, CERA, CFA, CPA, BFF, WYSIWYG, LOL, ETC.

The company argued that on emails, only a first and last name is necessary, and occasionally a middle initial. For every email the actuary sends and gets a reply from, the company has to fork over the extra cost of storing those bytes of data. This, over time, can amount to hundreds of dollars.

Monday, November 26, 2012

Smart Phone Passes Exam P/1

"I was leaving the exam center and the proctor gave me two print outs, one for me, and one for my phone."

Wednesday, September 12, 2012

Actuary Unable To Do Basic Math Without Excel

“I never saw this coming.” An actuary, who will just be referred to as Mr. X, lamented.

He was planning to assist his 8-year-old granddaughter with her math homework. The topic was division. Mr. X had no idea how to do it.

Wednesday, July 18, 2012

The Zen of a Cluttered Desk - Opinion

There are two types of people in this world, those with surgically sterile cubicles and those that have cubicles that could pass for small landfills. I’m writing on behalf of those of us who have the type of desk (or office if applicable) that would make our mothers cringe.

Actuary Discovers Hidden Code in Annuity Prospectus, Wins Lotto

A routine review of annuity product disclosers quickly became much more when an actuary stumbled upon a strange pattern of word and number combinations.

Actuaries Engineer Anti-Social Media

The proliferation of Facebook masks a simple truth. Some people are and always will be anti-social. It is against their nature to publish their lives, to paste their pictures on a virtual space, to describe their thoughts in 140 character snippets.

Most prominent among this crowd are actuaries. In response to the social media, they have developed several new websites under the umbrella Anti-Social Media.

Wednesday, May 16, 2012

Party Like an Actuary - Opinion

In my last piece, I talked about how sex appeal is never the first thing that comes to mind when someone thinks of actuaries, when in reality it’s been there all along. The other thing that we tend to hide from the world is our propensity to throw excellent parties.

Actuaries Force Lumberjacks to Refresh Image

Actuaries came in number 1 in the CareerCast.com ranking of 200 jobs, snug right between a Software Engineer and an HR Manager. Lumberjacks came in last.

In an effort to change their image, lumberjacks across the country have traded in their flannel shirts and beards for polos and clean shaves.

SOA Plans New Exam Track - Anything That Deals With Insurance

Recently the SOA released news that it would offer a General Insurance track. While this in itself is groundbreaking news, it overshadows an even more aggressive agenda of expansion that’s in the works.

Sources close to the inner working of the society indicate an even broader track with the minimal requirement that it some way ‘deals with insurance’. Candidates that successfully complete this track would get their DWI certificate.

Possible syllabus items include:

p Animals and Insurance: How to Pick a Mascot/Logo/Spokes-creature for your company

p Things that start with i

p Material from other professions (CPA, CFA, Medical Boards, JD)

p Some semi-professional exams – Bartending Certification, Class A Drivers Test , etc

Candidates will also have to demonstrate mastery of sports trivia, pop culture, the game of Monopoly, and select passages from the sacred texts of most world religions.

There was some slight confusion over a connect-the-dots and color-by- number placemat from a local dining establishment. It turned out that it wasn’t part of the proposed material, but was accidently placed there after the committee leader took his family out for Friday night dinner.

The SOA hopes to give out several hundred DWIs over the next few years.

Blue Book To Change Color

Driven by a combination of regulatory changes, updated technology, and Kermit the Frog’s Rainbow Connection, Ameriprise Financial leaders have proposed a radical change to annual reporting.

Currently they are evaluating a series of colors for the next few years, including daffodil yellow, sunny peach, hunter green, and cotton candy pink.

Thursday, March 22, 2012

Sexy and We Know it -Opinion

Our occupation may not be as glamorous as a rock star, as heroic as a firefighter, or as honorable as a teacher, but don't tell me actuaries aren't sexy.

I’ll admit that we may never make a top ten list of sexiest careers, but the point I want to make is that the sex appeal for actuaries is at least greater than zero.

Subscribe to:

Posts (Atom)

.jpg)

.jpg)