In an effort to find new business, insurers are dabbling into new, untapped markets.

Traditionally the insurance industry protected against two risks - dying to soon via Life Insurance or outliving your assets (longevity) via Annuities.

The limiting factor to each of these is that you either had to be alive or die to collect a claim. This was an issue if you were already dead, sort of dead, or came back to life after death. Now, a new set of products is coming on to the market to meet those needs.

Reanimation Insurance - Once you die your estate is often liquidated. It's hard to start over with nothing. Reanimation Insurance provides either lump sum or monthly payment streams upon reanimation, either partial or full.

|

| https://wallscover.com |

Second Death Insurance - This product is really for the niche of undead immortals, such as vampires. While no longer competing against an internal countdown clock, there are still hazards associated with this sort of existence. (Stakes to the heart, sunlight exposure, silver bullets, etc.) Second Death insurance protects your coven and any wealth acquired after initial death from financial loss due to total termination.

|

| Photo: Hopper Stone |

Optional Zombie Rider - while not a stand alone product, the zombie rider recognizes reanimation into a semiconscious state as a disability and waives premiums.

.jpg/1280px-Montreal_Comiccon_2016_-_Zombie_LEGO_Minifig_(27643957583).jpg) |

| Pikawil - Flikr |

On the P&C side of the house, insurers are now offering protection against the following hazards:

- Hauntings

- Inter dimensional portals

- Alien invasion

- Monster collision and attack

- Crypts and coffins

- Castles

- Liability for biological outbreak

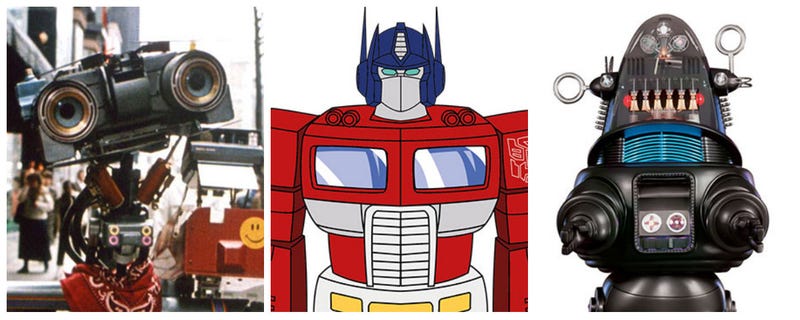

- Rogue robots

Recent developments for products related to loss of 2 or more ADLDs, commonly known as Activties of Daily Living Death: Hauntings, Possessions, Scaring the Crap out of someone (a.k.a induced incontinence), Sliming, Transitioning Between Various States, and general spookiness!

ReplyDeleteNew ideas and features for 2018:

ReplyDeleteDracula Dental - covers fang replacement and sharpening

Werewolf liability - new coverage on homeowners policies

Spells and Incantations Discounts - premium rate reductions available when protective charms are used.