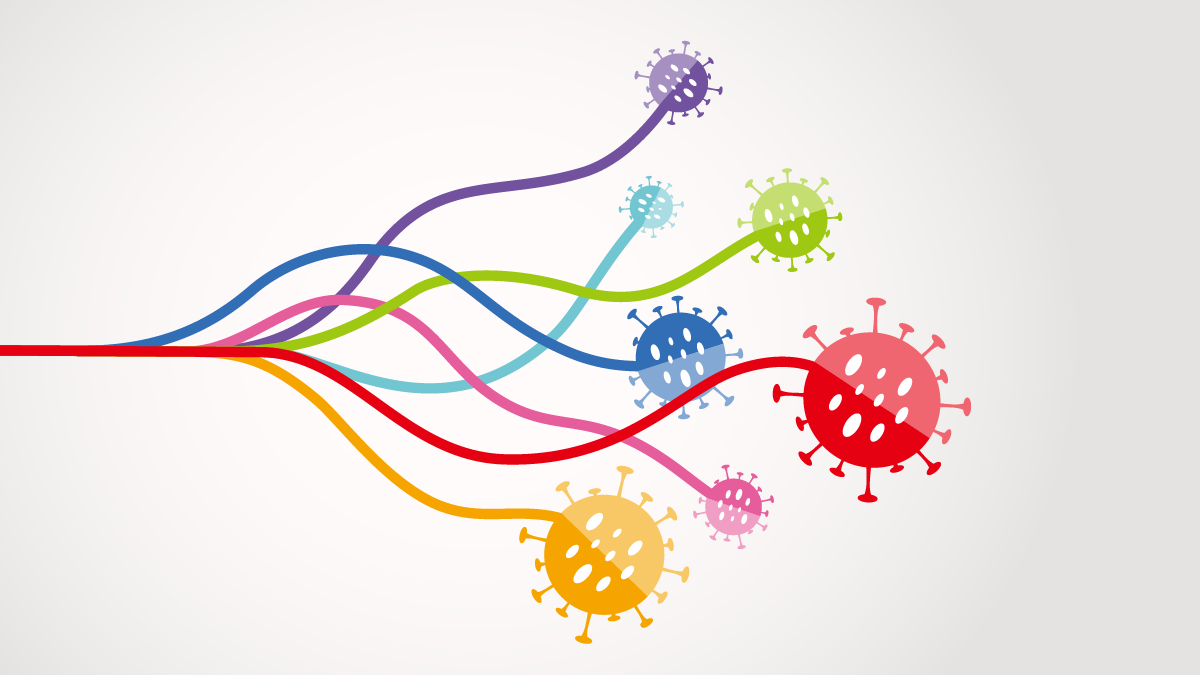

Last year, I wondered if I would be concluding my COVID series.

But COVID keeps causing problems, including excess mortality in Australia. And it's not the only trouble maker. It appears the last flu was nasty. And then there's this chicken and egg problem, and its not about which came first!

So, here we are. I am now going to declare that this will be an annual tradition indefinitely. Although COVID may not be the central topic in future episodes, it seems we will have enough stuff going on to perpetuate prolific pontifications.

If you are just now tuning in, in this series I like to use the context of the virus to explore decision making and uncertainty (including modeling), and the post-COVID world.

In this installment, there are a couple themes that we will explore.

First, this seems to be the age of retaliation, with more voices pushing back against previous policy decisions.

Secondly, there are some mean reversions occurring in the post-covid world, but there other items where COVID is still causing trouble.

).png)

).png)

.jpg)

.jpg)