What happens with actuaries when the lights go out? Between the Spreadsheets exposes the hidden secrets of the actuarial profession through satirical articles and thought provoking pieces. Ideas expressed in this blog are my own. They do not represent any company or organization.

Monday, February 27, 2023

Friday, February 17, 2023

NSFW Book Review: Everything is Your Fault by Stephan James

Friday, January 13, 2023

Eat Your Numbers: A Second Helping

Sunday, November 20, 2022

Book Review: The Ultimate Actuarial Joke Book and Best Tweets From Actuarial Problem Dog by John Lee

Thursday, November 3, 2022

Actuaries Are So Covert the CIA Wants Them As Spies!

The worn trope of the actuary is that they are total introverts - practically invisible. The job no one has ever heard of and no can explain. It doesn't even sound like a real thing. They even refer to themselves as 'unicorns.'

It turns out that this sort of elusiveness may be in demand by the CIA - and in this case, not the Canadian Institute of Actuaries, but the actual US Government Central Intelligence Agency.

A recent job opportunity popped up on the Society of Actuaries Website and while the job title is for a Science, Technology, and Weapons Analyst, we all know that this is just a front. This is a chance to build a network of undercover actuaries, a legion of nerdy spies that will assess and mitigate risks with silent proficiency.

Cue the Liam Neeson voice over:

..what I do have are a very particular set of skills. Skills I have acquired over a very long career. Skills that make me a nightmare for people like you...

The only remaining question is how do you like your martini - shaken or stirred?

(This post will self destruct in 30 seconds)

Friday, September 30, 2022

Hurricane Ian

I went toe to toe with Hurricane Ian on September 28, 2022. This was probably the craziest day of my life.

After 48 hours of anticipation and anxiety we were on the receiving end of a furious storm, pummeling our house with 100mph winds for hours and hours and hours.

A storm we thought would miss us, came and punched us square in the nose.

This morning, the sun rose, and I am grateful for today.

To be here.

With my family.

With four walls and a roof.

And just 40 miles to the west of me, things have completely disappeared.

And as I process through this, the thoughts that ring in my ears are bitingly poignant clichés about how precious our moments are.

How delicate and fragile we are.

How we need to continually to return to what really matters in this very short, very crazy, very beautiful life.

And of course, being an actuary, I am thinking about uncertainty and risk.

Tuesday, August 2, 2022

Book Review: Do Good Better by William MacAskill

I didn't realize that donating to charity could be an actuarial exercise! Yet after reading Doing Good Better by William Macaskill, I've realized yet another application of this skill set.

Saturday, June 4, 2022

Actuary Sets Bungee Jumping Record

Happily, this post is not parody - it really happened! Congrats to Francois-Marie Dibon who more than doubled the prior record.

Wednesday, April 27, 2022

Book Review: The Righteous Mind by Jonathan Haidt

The Righteous Mind is a book about morals. At first glance, morality may belong to the realm of philosophers and theologians, but not actuaries. Indeed, it may be hard to find a discourse on the greater good in a statistics text book. Yet, there are three reasons I think actuaries will find this book appealing:

- Much of what actuaries are concerned with involves predicting human behavior. Perhaps understanding someone's moral framework can yield insights about their risk taking behavior or why they'd even consider buying insurance (or cheating the insurer).

- The book provides mathematical framework for morality. The author introduces the Morality Matrix, which should get the actuarial taste buds salivating. Haidt expands left/right orientations into a deeper palate of dimension. For actuaries who enjoy component based studies, this will be a welcome analysis.

- Actuaries are humans, too. This book offers a look in the mirror, an opportunity to "know thyself" a little bit better, and also sheds some light on your fellow human beings.

Friday, April 1, 2022

Actuaryland: A Theme Park Designed By and For Actuaries

Inspired by recent activity on Twitter, a nationally recognized amusement park design firm is entering a concept phase for a new niche attraction.

The impetus of the idea came out of an exchange on the popularity of Bayesian Statistics - to which one @loveactuary responded "in actuaryland we love em" - to which @EvanSparks chimed in "Actuaryland: the theme park where all the roller coasters have accurate forecast for how long a guest can ride before throwing up." This is now commonly referred to as the Puke Index.

And thus a concept is born.

Like all theme parks, the admission price will likely cost a small fortune. @nateworrell went as far to say that all tickets will have to be 'prefunded.'

Even with a ticket, the entry into the park will likely require patrons to have to pass through a series of entry requirements, each one mentally and emotionally demanding. Less than half of ticketed guests are expected to actually make it into the park.

Once in the park there are several marquee attractions. Of course lines and wait times are going to be unavoidable - @Catuary1 adds a new twist with a policy not to disclose estimated wait times to park goers. Instead "they will roughly tell you how long the wait is but it is very vague...". This should certainly ramp up the levels of anxiety and apprehension!

And as you read the descriptions, it is important to remember that in Actuaryland "all the rides are simulations" (@nateworrell):

Friday, March 11, 2022

Viral Viruses - Booster Edition

Here we go with round 3 of the Corona series!

Chronicle/Recap:

- When a Virus Goes Viral (2020) - "It’s not an abnormal thing to wonder when things will get back to normal. I don’t believe they will, I don’t think they ever do."

- When a Virus Stays Viral (2021) - "I don't know what the right answer is, but if you are arguing for restaurants and bars to open up, tell me how many grandmas you are willing to kill. Conversely, if you want to save your grandma's life, tell me how many of your neighbors should lose their homes or jobs."

- Decision making/uncertainty

- Risk models

- Major structural changes in the world

- How do we recover all the bailout, relief money?

- How do rental markets/evictions unfold?

- Relocation effects?

- Company Mergers/Acquisitions - particularly in travel and entertainment

Tuesday, September 7, 2021

Box Tops and Other Ways to Earn Actuarial Credentials

Recently, the SOA announced new ways to get credit toward an actuarial credential via university credit. The approach was viewed with mixed results. The SOA claimed the initiative was motivated to foster inclusion. The Organization of Latino Actuaries wrote a public letter asking the SOA to withdraw the program on the basis that it is counterproductive to inclusivity goals.

Whether or not the SOA goes back to the drawing board remains to be seen. In the interim other means of credentialing actuaries are emerging.

Saturday, April 3, 2021

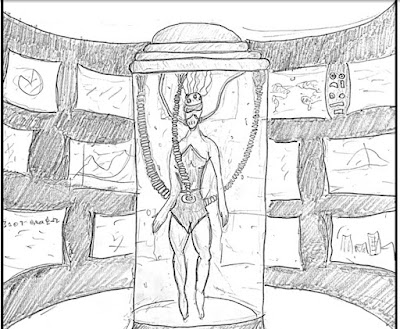

SF14 - A Glimpse Inside the Minds of Actuaries

Actuarial authors of the 14th Speculative Fiction contest wrote stories (or graphic novel, play, or transcript) that cover social issues, political unrest, and pandemic and climate crises. Yet, amidst the dystopia, there's a constant call to appeal to our better angels.

Wednesday, March 17, 2021

When a Virus Stays Viral

Last year I posted "When a Virus Goes Viral" -

Since then, I grew and shaved a corona beard:

I created parody songs - "Coronaville" (below), "My Corona" (which I made for my coworkers and has some inside references) and I put a spin on some holiday favorites ( like Baby There's Covid Outside).

I made some good progress on my Netflix backlog.

It seem the rest of the world has been doing the best it can to get through the pandemic. How are you doing folks?

I wanted to do some reflecting and revisiting. As a recap, there are 3 items that I was curious about:

- Irrationality

- Evolutions in risk modeling

- The post-COVID world.

Disclaimers: These observations are U.S. oriented.

Thursday, February 11, 2021

Octavia Butler Would Have Been A Great Actuary

As I was scanning through the world of Speculative Fiction*, looking for inspiration for my next entry in to the Society of Actuaries Speculative Fiction contest, I found, and fell in love with, the writing of Octavia Butler.

"Speech Sounds" is a short story that somehow manages to capture the entirety of the human experience, our demons and our angels, in 20 pages. It features a woman trying to survive in the middle of a pandemic that impairs our ability to communicate. Sometimes fictions mirrors reality quite well.

I take refuge in Octavia's words about the story in the afterword:

“Speech Sounds” was conceived in weariness, depression, and sorrow. I began the story feeling little hope or liking for the human species, but by the time I reached the end of it, my hope had come back. It always seems to do that."

Perhaps it is not too surprising that we find our world reflected in her writings. While we might not have to deal with telepathic vampires, we certainly do live in a world that has to deal with the consequences of the human tendency to create hierarchies.

In her NPR essay, Octavia posits that we might be fatally destined to cycles of domination. Yet, she concludes with the following question:

Amid all this, does tolerance have a chance?

Only if we want it to. Only when we want it to. Tolerance, like any aspect of peace, is forever a work in progress, never completed, and, if we're as intelligent as we like to think we are, never abandoned.

But what do her musings on the human condition have to do with being an actuary?

Friday, October 9, 2020

Insurance Rocks!

Lemonade recently posted reviews of some bands you may have never heard of before (possibly because they don’t exist).

Sunday, September 13, 2020

Book Review: Winning Conditions by Christine Hofbeck

I remember my initial reaction when I heard that there was going to be an actuary on Survivor.

"She'll probably win." I said, without hesitating.

And I remember the stunned look of my coworker, who was struggling to imagine the cube dwelling nerds she knew trying to endure the rigor of a survival based game.

I had no idea who Christine was. And perhaps I was a bit overconfident and biased about the skills of my fellow actuaries. Although, I think my gut reaction was well founded.

- Many actuaries make a career out of working with life and death statistics, and all of us studied survival curves along the way, so the subject is in our blood.

- I had played poker (and another elaborate card game that was different each time you play) against other actuaries, and had witnessed the shrewdness with which they play.

- The fact that the TV show thought she'd be worth being on camera signaled to me that she probably had some moxie.

- I knew she'd be the underdog, which would give her an competitive edge. She'd be out to prove something and the other competitors would underestimate her.

Sunday, June 14, 2020

Do You Know More About Your Uber Driver Than Your Local Police Officer?

Meaningful Change Requires Meaningful Data

Friday, June 12, 2020

Manager Thought Actuary was Protesting for a Decade

Monday, April 6, 2020

Book Review: Being Wrong - Adventures in the Margin of Error by Kathryn Shulz

A while back I put out a piece on the blog that looked at occupations where being wrong is part of the job description.

And more recently I won an essay contest by explaining that I am an Idiot.

I love stories of the hapless fool - the Don Quixote's and Confederacy of Dunces of the world.

I picked up this book from a really good article series "Studying Studies" by a smart dude named Peter Attia. I may keep working through his reading list.

If you're the kind of person who loves droning about the nature of the universe at your favorite craft brewery, I know I am, this book is for you.

Thursday, March 19, 2020

When a Virus Goes Viral

Thursday, August 8, 2019

Advice from a Pro! 37 Life Lessons.

Here are his "37 Lessons Actuarial Science Has Taught Me About Life"

Tuesday, August 6, 2019

Eat Your Numbers

Saturday, July 13, 2019

Book Review: Scythe Series by Neal Shusterman

We’ve conquered death! Awesome! Well more accurately , we developed nearly omniscient Artificial Intelligence (the Thunderhead) that solved all our problems. The answer wasn’t 42 after all.

However, a world with no death faces two challenges.

1. Death (and avoiding it) is a motivating factor to live well.

2. The planet can only handle so many people.

To counter these issues, the creators of the Thunderhead established a league of special individuals that are exempt from monitoring by the Thunderhead. Known as the Scythdom, these people have a singular mandate - the administration of mortality.

Tuesday, January 8, 2019

2018 Actuarial Awards

Roll out the red carpet! Awards are everywhere....Emmys, Grammys, ESPYs, oh my!

While not given the exact same spotlight, or fancy evening wear, actuaries give out their own sets of Awards. The 2018 summary is below.

Friday, August 10, 2018

Are Actuaries Born or is it a Choice?

When Rita was 3 years old she had a tendency to stack blocks in probability distribution shapes. At first her mother thought the patterns were just imaginative. But then when Rita started making histograms with candy pieces and named her pet hamster 'chi-squared', she understood there was something else at play. Rita is now a junior in college and is bristling with excitement at starting her first internship at an insurance company in the actuarial department.

When Rita was 3 years old she had a tendency to stack blocks in probability distribution shapes. At first her mother thought the patterns were just imaginative. But then when Rita started making histograms with candy pieces and named her pet hamster 'chi-squared', she understood there was something else at play. Rita is now a junior in college and is bristling with excitement at starting her first internship at an insurance company in the actuarial department.Angela is also starting her first internship in the same area. She still isn't sure if the actuarial science will live up to its hype. She's also thinking about the possibility of being a math teacher or trying to make it as a drummer in a female punk rock band.

Both women represent two ends of the hotly debated topic - are actuaries born or is it a choice?

Saturday, July 21, 2018

Between the Spreadsheets and In the Closet

NERD CLOSET

This is a resource page where I will share an post items that I find to be useful as a nerd, an actuary, and as a basic human on the planet.

Take a look for yourself and let me know what you think.

Some products are affiliate links.

Thursday, June 7, 2018

Big Data needs Big Actuaries

Some speculate that the Academy may also produce a monolith dedicated to Big Data as well.

Or maybe a monogram.

Either way, what is certain is that Big Data and the applicable statistical methods that come along with it are going to play a significant role in the actuarial profession.

And in order to handle Big Data, you need a Big Actuary.

Thursday, May 17, 2018

Review of the Human Longevity Project Series

Monday, March 12, 2018

March Madness 2018 - Actuarial School Bracket

The full bracket is available here (may require CBS login):

http://freebracketchallenge.1.mayhem.cbssports.com/brackets/1/njworrell

Thursday, March 8, 2018

I'd Like to Thank The Academy....2017 Actuarial Awards Summary

| |

The Oscars completes the awards season. Awards are everywhere....Emmys, Grammys, ESPYs, oh my! Even the POTUS submitted his own version of awards.

While not given the exact same spotlight, or fancy evening wear, actuaries give out their own sets of Awards. The 2017 summary is below.

Friday, November 10, 2017

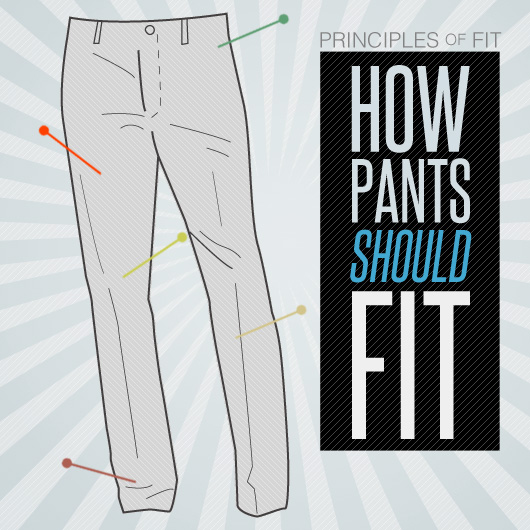

New Actuarial Standard on How To Put on Pants

Recent ASB proposals for modeling, pricing, and assumption setting standards of practice seem to be starting a trend of codifying every single action an actuary takes. The latest release seems to confirm this theory.

An exposure draft, titled "Lower Body Coverings" is currently in progress.

Apparently there is much concern in the actuarial community about the quality of work can vary based on how one applies lower limb coverings. An improper procedure may result in further deterioration of judgment, confidence, and overall work product. To put it one way, the exposure draft deals with the risks of feeling drafts while exposed.

Saturday, October 7, 2017

New Insurance Products Announced for Undead

In an effort to find new business, insurers are dabbling into new, untapped markets.

Traditionally the insurance industry protected against two risks - dying to soon via Life Insurance or outliving your assets (longevity) via Annuities.

The limiting factor to each of these is that you either had to be alive or die to collect a claim. This was an issue if you were already dead, sort of dead, or came back to life after death. Now, a new set of products is coming on to the market to meet those needs.

Friday, September 1, 2017

Bayesian Rhapsody

Update: The Bohemian Rhapsody movie did not take any of this information into account.

Is this just fantasy? Pr(Fantasy) = 1 - Pr(Real Life)

Caught in a landslide,

No escape from reality Pr(Real Life | Caught in a landslide ) = 1

Friday, March 3, 2017

The 12th Actuarial Speculative Fiction Contest

Thursday, January 5, 2017

You Wouldn't Believe What Jacob Bernoulli Looks Like Now

The Bernoulli's

Wednesday, October 19, 2016

Models and Drunks

First, models. I have long been a fan of the phrase that "all models are wrong, but some are useful." However, much to my shame, I know not where it came from. Now I do. Thank you Twitter for enlightening me about George Box and his paper. Not only am I know aware, but I have been shaken to my core. More on that later.

Second, drunks - and specifically how they walk. The Drunkard's Walk: How Randomness Rules Our Lives by Leonard Mlodinow (http://leonardmlodinow.com/) is what I call a mathematician's apologetic - an attempt to make math accessible to the masses. His book is part of my attempt to work through a reading list (again - thanks Twitter!) of math texts. I give the guy a couple of stars for effort on the mathematical narration, but the real gold is in the cast of characters. They will be featured in a future post. In this post, I will leave you with flip flops.

Sunday, September 4, 2016

Vitality Compass vs. Longevity Illustrator

Wednesday, August 17, 2016

Engage or Disengage?

https://engage.soa.org/home

While unlikely to get the traction of the Actuarial Outpost or a Reinsurance sponsored Happy Hour at a symposium, the threshold is pretty low. A few actuaries showing up will likely be considered a win.

This initiative brings to mind a past article by BTS, about actuaries engineering anti-social Media.

http://betweenthespreadsheets.blogspot.ca/2013/04/actuaries-engineer-anti-social-media.html

Saturday, July 9, 2016

If Donald Trump Ran for SOA President

We pulled the questionnaire from the society's website and did our best to imagine how the Donald may have answered, pulling direct quotes where possible, indicated by " ", everything else is fiction.

Readers are welcome to add Trumpisms that may apply.

Wednesday, June 22, 2016

Actuarial @ASAPscience

And yes, bulk of our discipline is math and probability based, but let us not kid ourselves that we are unique in our application of these subjects.

- The Random Walk a.k.a Brownian Motion - comes from physics

- Regressive models are scattered across scientific fields from sociology to biology

- Sampling Techniques, a.k.a Experience Studies, are present in marketing and politics

- Game Theory comes from...A Beautiful Mind. Kidding. Economics and psychology

Monday, June 6, 2016

I Get Knocked Down, But I Get up Again

Then came the day that I never saw coming.

Wednesday, March 9, 2016

Paid To Be Wrong vs. Paid to be Right

Friday, March 4, 2016

Comedian Louis CK Goes Full Actuary

Friday, December 18, 2015

The Fed Awakens - Actuarial Reactions Vary

| Image from Jeff Burney at http://www.cartoonmovement.com/cartoon/26133 |

Friday, September 25, 2015

New Clipped Art - Actuarial Tombstone

Monday, August 17, 2015

If There was a Fantasy League for Actuaries....

Rosters need to include:

3 Pre-ASA Students

2 Post-ASA Students

3 Fully Credentialed Actuaries, one of which must be a consultant

1 Appointed Actuary

1 Chief Actuary

1 Insurance/Financial/Software/Risk Management Company that employs at least 50 actuaries

Scoring:

10 points per preliminary exam passed

5 points first time pass bonus

2 points per FAP module completed

3 points per passed Assessment

20 points per FSA/FCAS exam passed

4 points per FSA module completed

5 points for acheiving any credential (FSA, FCAS, CERA, ASA, etc.)

1 point per hour of CPD

7 points for any signed statement of actuarial opinion or rate filing

3 points per hired actuary

-3 points per lost actuary

-5 points for any ABCD greivance filed against anyone on the roster

Sunday, August 16, 2015

Society of Actuaries Logos That Didn't Make the Cut

The "infinity shield", according the brand website "symbolizes that the SOA is continually evolving to produce forward-thinking education and professional development opportunities. The shield represents a strong, fortified foundation, bound by standards and principles that advance your interests."

Wikipedia calls it an "impossible object".

So, quite simply, the essence of an actuary is represented by an infinite impossibility. Fitting, as much of the public still has no idea what actuaries do and some still doubt that actuaries actually exist. Why not be represented by a geometric symbol from the realm of mythology and legend?

Sources leaked some alternative designs that almost made the cut:

.jpg)

.jpg)